Understanding what is a FICO score is crucial for managing your financial health. Your FICO credit score is a three-digit number that represents your creditworthiness and is used by lenders to determine your credit risk. A higher FICO score indicates better creditworthiness, while a lower score may signal higher credit risk. Here are some key points to help you understand your FICO score in more detail:

What is a FICO credit score?

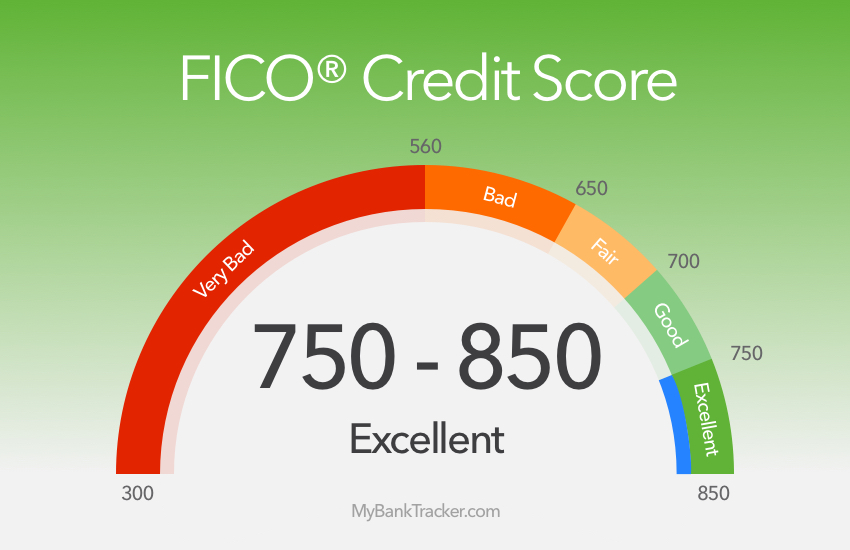

The term “FICO” stands for Fair Isaac Corporation, the company that developed the scoring model. The FICO score ranges from 300 to 850, with a higher score being more favorable. The score is calculated based on the information in your credit report, which is compiled by the three major credit bureaus: Equifax, Experian, and TransUnion. Each bureau may have slightly different information, leading to minor variations in your FICO score between them.

Factors affecting your FICO score

Your FICO credit score is calculated using a combination of several factors, each carrying a different weight in the calculation. These factors include:

a. Payment history: Your payment history is the most significant factor affecting your FICO credit score. It accounts for about 35% of the total score. Lenders want to see a track record of on-time payments, as late payments or delinquencies can significantly lower your score.

b. Amounts owed: The total amount of debt you have, including credit card balances, loans, and other debts, contributes to about 30% of your FICO score. It’s crucial to keep your debt levels low and manage your credit utilization, which is the percentage of your available credit that you are using. Keeping your credit utilization below 30% is generally recommended for a healthy FICO score.

c. Length of credit history: This factor considers the length of time you’ve had credit accounts open. A longer credit history is generally more favorable for your FICO score, as it demonstrates your ability to manage credit responsibly over time.

d. Credit mix: Having a mix of different types of credit, such as credit cards, loans, and mortgages, can positively impact your FICO credit score. This factor accounts for about 10% of your score. It shows that you can handle various types of credit responsibly. However, remember to only take on credit that you can comfortably manage.

e. New credit: This factor considers the number of new credit accounts you’ve opened recently. Opening multiple new credit accounts within a short period can negatively impact your FICO credit score, as it may indicate financial instability or a higher risk of default. Be cautious when applying for new credit and only do so when necessary.

Regularly monitoring your FICO credit score

To maintain a healthy financial profile, it’s essential to check your FICO credit score regularly. You can obtain a free copy of your credit report annually from each of the three major credit bureaus. By reviewing your credit report, you can ensure that the information used to calculate your FICO credit score is accurate and up to date. Additionally, monitoring your score allows you to identify any errors or discrepancies that might be affecting your creditworthiness.

Understanding your FICO score empowers you to make informed financial decisions. By maintaining a good FICO credit score, you can access better loan terms, lower interest rates, and improve your overall financial well-being. It is important to develop effective strategies to improve and maintain your FICO credit score. This can include paying your bills on time, keeping your credit utilization low, and being cautious when applying for new credit.

If you find that your credit score needs improvement, there are steps you can take to gradually build a stronger credit profile. Start by paying your bills on time and reducing your debt levels. Make sure to use credit responsibly and avoid taking on more credit than you can handle.

Additionally, you can consider using credit monitoring services to keep track of changes in your credit report and score over time. These services can alert you to potential issues and help you identify areas for improvement.

In conclusion, your FICO credit score is a vital financial tool that influences your ability to obtain credit, loans, and favorable interest rates. Understanding the factors that contribute to your score can help you make smarter financial decisions and work towards improving your creditworthiness. By managing your credit responsibly and monitoring your FICO score regularly, you can take control of your financial future and achieve greater financial freedom.

To learn more about your fico credit score and how to fix or get a higher score visit My Better Fico for credit repair services.

Frequently Asked Questions (FAQ)

1. What is a FICO score?

A FICO score is a three-digit number that represents an individual’s creditworthiness. It ranges from 300 to 850, with a higher score indicating better creditworthiness.

2. How is a FICO score calculated?

FICO scores are calculated based on various factors, including payment history, amounts owed, length of credit history, credit mix, and new credit. Payment history and amounts owed have the most significant impact on the score.

3. What is considered a good FICO score?

A FICO score of 670 or higher is generally considered good. Scores above 740 are typically classified as very good, while scores exceeding 800 are considered excellent.

4. Why is a good FICO score important?

A good FICO score is crucial for accessing credit options with favorable terms, lower interest rates, and better borrowing opportunities. It can also impact employment, housing, and utility service approvals.

5. How can I achieve and maintain a good FICO score?

To achieve and maintain a good FICO score, make timely payments, reduce debt, avoid excessive credit applications, keep old accounts open, and regularly monitor your credit.

6. How often should I check my credit reports?

It is recommended to check your credit reports from the three major credit bureaus annually to ensure accuracy and detect any potential issues.

7. Can I improve my FICO score over time?

Yes, with responsible credit management habits, such as making on-time payments and reducing debts, you can work towards improving your FICO score over time.

8. Should I close old credit accounts?

Closing old credit accounts can shorten your credit history, potentially impacting your score negatively. It is advisable to keep old accounts open, even if you no longer use them regularly.

Pingback: A Good FICO Score - How to Get One - MBF Consulting Services

Pingback: Understanding the Credit Score Scale - MBF Consulting Services

Pingback: Understanding Tradelines and How to Use Them - MBF Consulting Services