A good FICO score is essential for achieving financial stability and unlocking opportunities such as obtaining loans, securing lower interest rates, and gaining access to better credit card offers. Your credit score reflects your creditworthiness and financial responsibility, and it plays a significant role in shaping your financial future. In this blog article, we will explore the importance of a good FICO score and provide valuable tips on how to achieve and maintain it. If you’re looking for expert advice and resources to improve your credit score, visit MyBetterFICO.com.

Understanding FICO Score and Credit Report

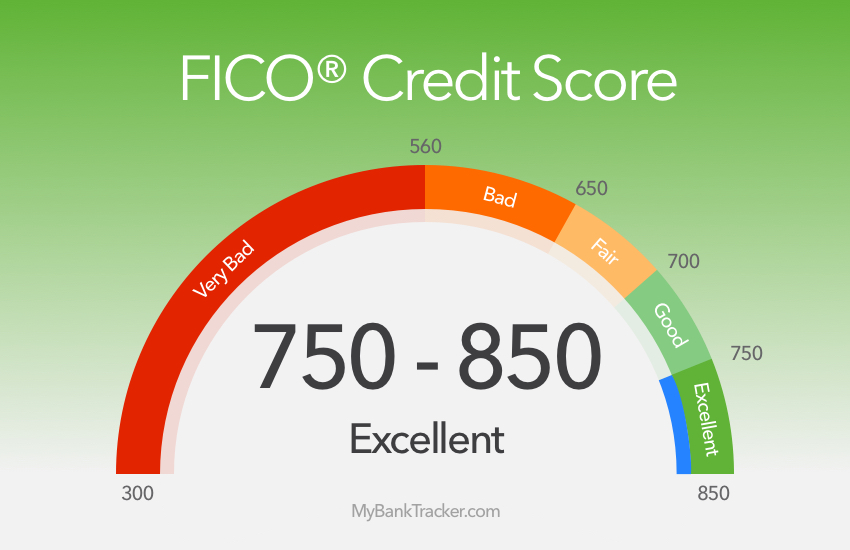

A FICO score is a credit score developed by the Fair Isaac Corporation, which is widely used by lenders to assess an individual’s credit risk. FICO scores range from 300 to 850, with higher scores indicating better creditworthiness. To get started on the journey to a good FICO score, it’s crucial to understand the factors that influence it. Your payment history, credit utilization, length of credit history, credit mix, and new credit applications all impact your FICO score. Additionally, regularly checking your credit report is essential to identify any errors or discrepancies that may be affecting your score negatively.

Maintaining a Good FICO Score

Image credit: nfcc

1.1 Pay Bills on Time: The most critical factor in maintaining a good credit score is consistently making on-time payments. Delinquent payments can significantly harm your FICO score, so setting up reminders or automatic payments can be helpful.

1.2 Keep Credit Utilization Low: Credit utilization refers to the percentage of your available credit that you are using. Aim to keep your credit utilization below 30% to demonstrate responsible credit management.

1.3 Avoid Opening Unnecessary Credit Accounts: While having a diverse credit mix can be beneficial, avoid opening multiple credit accounts within a short period as it may be perceived as a risk by lenders.

1.4 Don’t Close Old Accounts: Length of credit history matters in your FICO score, so refrain from closing old credit accounts. Instead, keep them open and occasionally use them for small purchases.

Tips for Improving Your Credit Score

2.1 Check Your Credit Report Regularly: Monitoring your credit report helps you identify errors or fraudulent activities. If you find any discrepancies, report them to the credit bureaus immediately for rectification.

2.2 Address Outstanding Debts: Create a plan to pay off outstanding debts systematically. Reducing debt balances can have a positive impact on your credit score over time.

2.3 Negotiate with Creditors: If you’re struggling with debt repayment, consider negotiating with creditors for more favorable terms or setting up a payment plan that suits your financial situation.

2.4 Limit Credit Applications: Applying for multiple credit accounts within a short timeframe can lower your credit score. Only apply for credit when necessary and avoid making numerous inquiries.

Utilizing MyBetterFICO.com to Achieve a Good Credit Score

MyBetterFICO.com is a comprehensive platform that offers valuable resources and tools to help individuals improve their credit scores. By visiting the website, you can access a wide range of services, including credit score simulators, personalized credit improvement plans, and educational materials on credit management.

A good FICO score is a valuable asset that opens doors to financial opportunities. By understanding the factors that influence your credit score and implementing responsible credit management practices, you can steadily improve your creditworthiness. Remember to visit MyBetterFICO.com for expert advice and resources to guide you on your journey to a better credit score. Start today, and secure a brighter financial future!

Pingback: What is a FICO score?

Pingback: Understanding the Credit Score Scale - MBF Consulting Services

Pingback: How to Achieve a Perfect Credit Score - MBF Consulting Services

Pingback: Understanding Tradelines and How to Use Them - MBF Consulting Services